An intelligent wallet that saves you time and money

Built for the new era of smart personal finance

The Spending Trap Consumers Face Today

Multiple Cards, Multiple Fees

The average consumer has 3-5 credit cards, each with their own fees, interest rates, and reward structures. Keeping track of which card to use when is nearly impossible.

Time-Consuming Financial Management

People spend an average of 0 hours per year just managing their finances, checking accounts, and making payment decisions.

Missing Out on Rewards

Studies show consumers miss out on over $0 in rewards annually by using the wrong card for specific purchases or not optimizing their spending habits.

High Interest Costs

The wrong payment method choices can lead to unnecessary interest charges—the average credit card user pays over $700 in interest annually.

How Artha Intelligently Optimizes Your Spending

Intelligent Payment Routing

Automatically selects the optimal card for each purchase based on rewards, fees, and existing balances.

Personalized Financial Insights

Provides customized recommendations to improve your financial health based on your specific spending habits.

Automated Savings Goals

Sets up intelligent saving strategies based on your income, expenses, and financial objectives.

Real-time Decision Support

Get instant notifications about which payment method to use at checkout, maximizing your rewards and minimizing costs.

Key Features

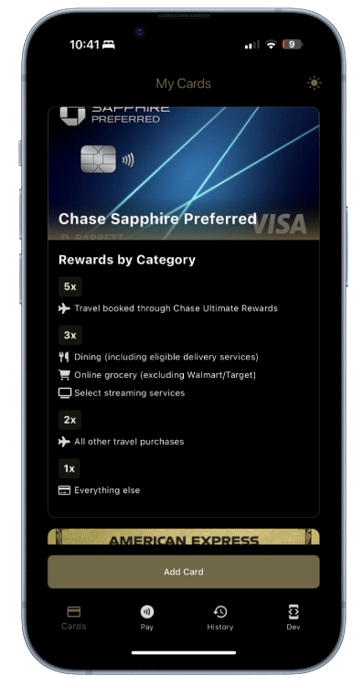

Card Optimization

Automatically selects the best card for each purchase to maximize rewards and minimize fees.

- Smart card selection

- Reward maximization

- Interest minimization

Spend Tracking

Keep track of all your spending across multiple accounts in one unified dashboard.

- Real-time balance updates

- Category analysis

- Spending patterns

Financial Insights

Personalized recommendations and insights to improve your financial health.

- Custom recommendations

- Savings opportunities

- AI-powered forecasting

Why Choose Artha

| Artha Wallet Smart Finance | Traditional Banks Banking Apps | Budgeting Apps Mint, YNAB, etc. | |

|---|---|---|---|

| AI-Powered Card Selection | |||

| Multi-Card Integration | |||

| Real-time Decision Support | |||

| Spending Analytics | Basic | ||

| Personalized Savings Opportunities | Limited |